how to avoid tax on 457 withdrawal

Section 457 of the Internal Revenue Code IRC is all about deferred compensation plans for state and local governments and tax-exempt organizations. When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan.

How To Claim Hardship For Cashing Out My 401 K

Both plans allow you to contribute money towards retirement on a tax-deferred basis.

. If you have a Roth 401k account you wont be required to pay any income taxes as long as youve held the account for at least five years. Withholding elections can be changed at any time by submitting a new Form W-4P or making a new election online. You can make a withdrawal at any time and still continue to contribute to the plan even after you take some money out.

Your employer will provide you with the required forms. A Roth 401k is funded with after-tax dollars and you only pay taxes on contributions. If you left your employer in or after the year in which you.

1 of the tax year when the first contribution was made. For the most part the plan operates similarly to a 401k or 403b. Withdrawals taken before you reach age 59 12 may incur an additional 10 early distribution penalty tax under section 72 of.

The 457 plan is a type of nonqualified tax advantaged deferred-compensation retirement plan that is available for governmental and certain nongovernmental employers in the United StatesThe employer provides the plan and the employee defers compensation into it on a pretax or after-tax Roth basis. The money is not taxed if loan. The IRS requires that you exhaust all the loan options available under your 401k plan before taking a hardship withdrawalA 401k loan typically allows you to borrow up to 50 percent of the value of your account tax-free provided you follow certain regulations in paying it backIf your hardship is short-term in nature and you are willing to pay back the amount you.

However if the withdrawal qualifies as a hardship withdrawal you may get an exception for the 10 penalty tax. Federal Income Tax Rate. If you decide to withdraw contact your employer and explain that you would like to withdraw funds from your SIMPLE IRA.

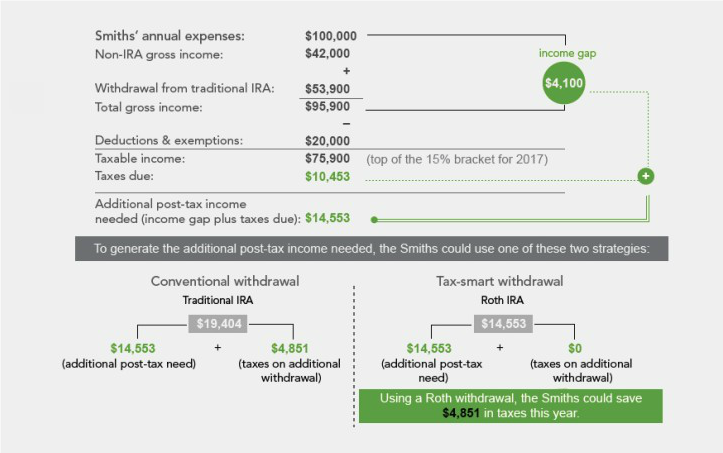

How 457b Plans Work. Withdrawals of earnings are subject to taxes and penaltiesYou may be able to avoid the penalty but not the taxes if you use the money for a first-time home purchase qualified. While there are similarities between a 457b and a 401k there are also key differences to keep in mind.

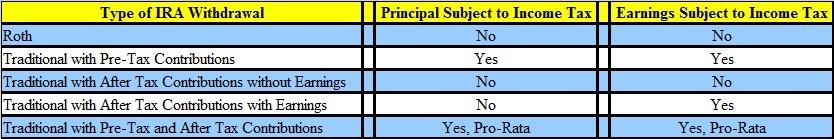

These contributions and all associated earnings are not subject to tax until withdrawal. Pre-tax contributions to a 457b plan reduce the employees taxable income for the year. Most IRA withdrawals are reported to the IRS.

The key point to understand about 457b plans is that they are deferred compensation from your. Estimate your marginal Federal income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. You may be able to avoid quarterly estimated tax payments.

John Hancock must report to the IRS all taxable withdrawals that exceed 10. But that may not be as bad as it sounds. Any withdrawal of funds from your plan will be subject to ordinary income tax.

457b are reported on Form 1099-R using code G. IRA withdrawals are considered early before you reach age 59½ unless you qualify for another exception to the tax. Plan at retirement you will not be allowed to repay the hardship withdrawal back to your retirement account You must pay income tax on any previously untaxed money you receive as a hardship distribution You may also have to pay an additional 10 tax unless youre age 59½ or older or qualify for another exception.

Including the amount of the cash withdrawal from your retirement plan. A tax year begins on Jan. If the plan doesnt allow a hardship withdrawal you may have to bite the bullet take a withdrawal and pay both the tax and the.

Notify your employer and request withdrawal forms. There are three long-term capital gains tax rates and they are based on your ordinary income tax bracket as follows. FEDERAL TAX WITHHOLDING CASH WITHDRAWALS Cash withdrawal payments include but are not limited to Lump Sums Systematic Withdrawals dividends.

Employees may be able to make after-tax Roth contributions which allow for potentially tax-free withdrawals. But if you can work a hardship withdrawal the 10 early withdrawal penalty is eliminated. The most common type of plan seen under this section is a 457b plan.

The taxable portion of a full or partial withdrawal is considered ordinary income for tax purposes. WITHDRAWAL REASON IRA assets can be withdrawn at any time. 403b or governmental deferred compensation plan IRC Sec.

See Retirement Topics Tax on Early Distributions for a chart of exceptions to the 10 tax. A retirement plan loan must be paid back to the borrowers retirement account under the plan. Each TIAA payout is considered separately when calculating the tax withholding.

For example a Roth IRA contribution for 2021 can be made up to April 15 2022 but it counts as if it were made. If your income is between 0 to 39375single or 0-78750joint your long-term capital gains rate is 0. Under age 59½.

How To Withdraw Money From Your 401 K Know Better Plan Better

Using The Rule Of 55 To Take Early 401 K Withdrawals Smartasset

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

Roth Ira Withdrawal Rules Estime De Soi Releve De Compte Assurance Vie

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

A Guide To 457 B Retirement Plans Smartasset

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

How Much Tax Do I Pay On 401k Withdrawal

How To Withdraw From Your Traditional 401 K Account Early And Avoid Penalties And Fees

What Happens If I Withdraw Money From My Tax Deferred Investments Before Age 59 Coastal Wealth Management

Roth Ira Withdrawals The Fi Tax Guy

How Can I Get My 401 K Money Without Paying Taxes

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

A Guide To 457 B Retirement Plans Smartasset

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

Here S How To Avoid Costly Mistakes If You Inherit A 401 K Or Ira

Four Tax Efficient Strategies In Retirement Fidelity Institutional